Micro Captive Insurance Companies

In issuing this notice, treasury and the irs continue their scrutiny of captive insurance transactions that they deem to be abusive. Many large companies have at least one captive and captives have also become popular among smaller and midsized firms.

South Beach January 2012 (With images) Vacation trips

South Beach January 2012 (With images) Vacation trips

A micro captive is a small captive insurer that has special taxation rules.

Micro captive insurance companies. Under section 831(b) of the internal revenue code, certain small insurance companies can choose to pay tax only on their investment income. A captive insurance company may be. Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution.

Captives are not exclusive to big companies. Captive insurance companies enjoy certain tax advantages. Establishing a micro captive for your business can:

It cited “abuse involving a legitimate tax structure [involving] certain small or ‘micro’ captive insurance companies.” Taxpayers urged to consult independent tax advisor before oct. These are risks that business owners have determined not to cover though traditional commercial carriers for a number of.

You may have heard about captive insurance before but most people i have met do not have a firm understanding of exactly what they are, who they are right for, and. The insurance industry is broken and successful business people should take advantage of the federal laws that allow them to escape the hard and soft market cycles of traditional insurance and start their own insurance companies. If the captive’s annual premiums don’t exceed $2.3 million and it meets certain diversification requirements, the captive can make an election under internal revenue code §831(b) to not include premiums in income and only be taxed on investment income.

One of the things irs agents and auditors greatly frown upon is the practice of creating tax shelters and shell companies to deliberately flout tax laws or claim deductions for which you are not legally eligible. Under section 831(b) of the internal revenue code, certain small insurance companies can choose to pay tax only on their investment income. 15 deadline quickly approaching, the internal revenue service today encouraged taxpayers to consult an independent tax advisor if they.

A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. Businesses can create captive insurance companies to insure against risks. Insured claims a deduction for the premiums paid under § 162.

3, the irs listed captive insurance among its “abusive tax shelters” on the irs “dirty dozen” list of tax scams.

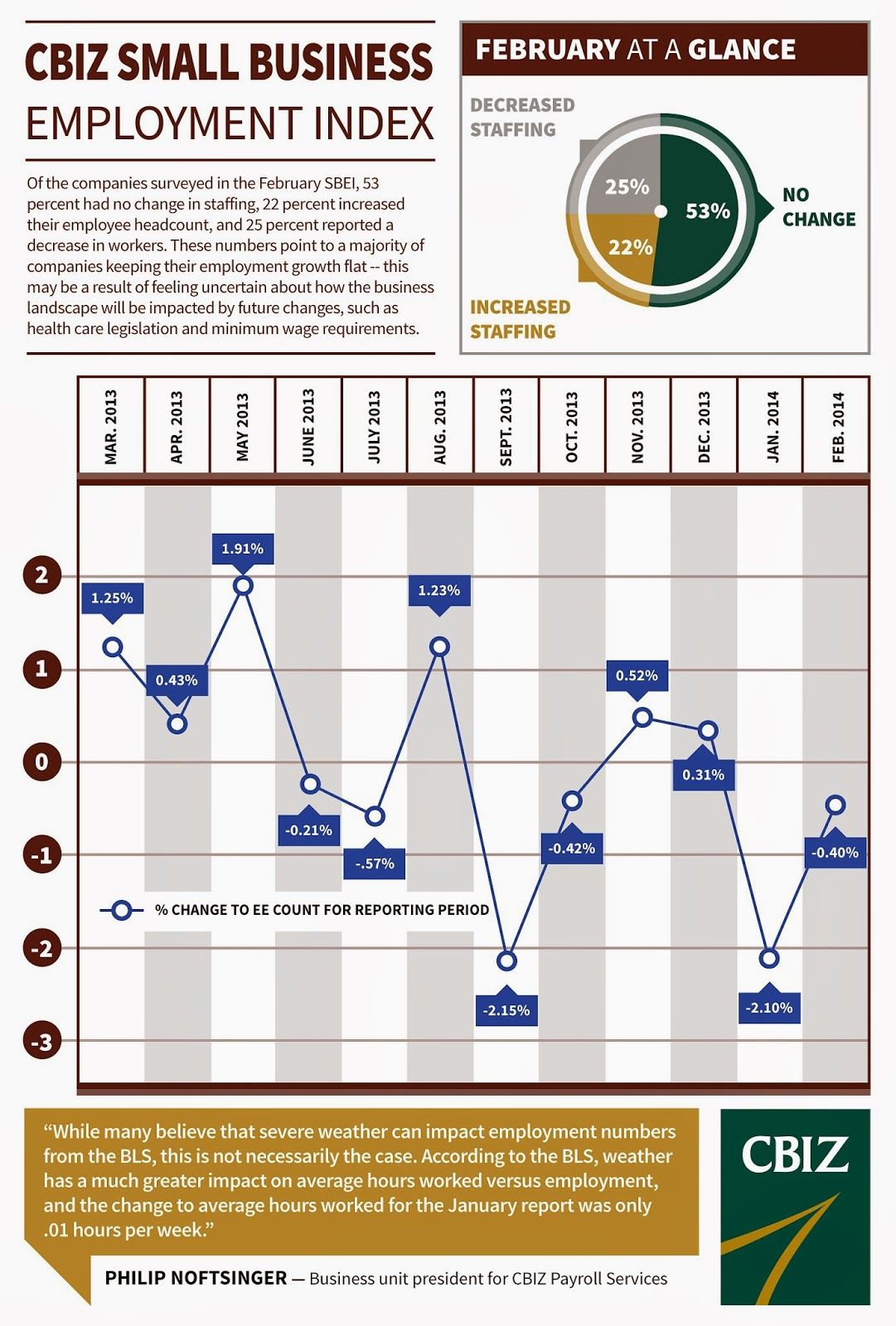

Slow start for 2014 hiring employment index

Slow start for 2014 hiring employment index

Technique how to earn new loyal customers in business

Technique how to earn new loyal customers in business

Slow start for 2014 hiring employment index

Slow start for 2014 hiring employment index

What you need to stop spending money on if you truly want

What you need to stop spending money on if you truly want

Featured Founders highlights ….From Aspen Capital Fund. in

Featured Founders highlights ….From Aspen Capital Fund. in

Wild Mountain Thyme (With Lyrics) (avec images) Musique

Wild Mountain Thyme (With Lyrics) (avec images) Musique

small toyota truck models small used trucks Check more

small toyota truck models small used trucks Check more